The Heritage Fund

Investing in the Heritage Fund is an investment in the TCA of today and tomorrow. Gifts to the Heritage Fund can be given unrestricted to benefit areas of greatest need, or designated to a specific area of the school. No gift is too small when investing in Christian education. Join us and make an eternal impact by supporting our Heritage Fund. Every gift, no matter the amount, can be used to benefit a multitude.

How does my gift make an impact?

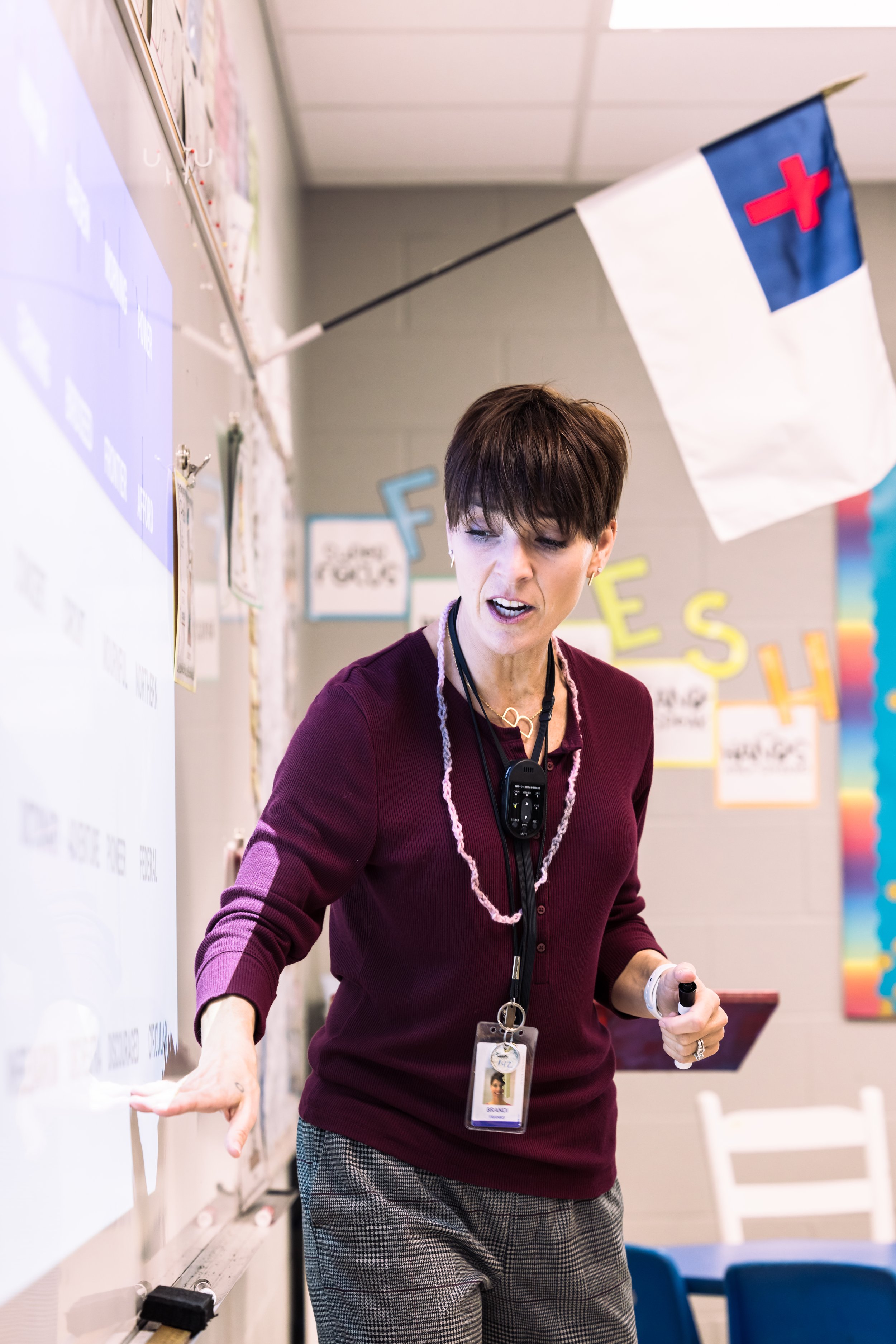

When you give to the Heritage Fund, you are partnering in mission with TCA. Giving an unrestricted gift meets annual needs, allowing us to keep tuition costs as low as possible while also paving the way for our school to thrive. Here are some of the ways giving to the Heritage Fund impacts furthering our mission:

Financial Aid

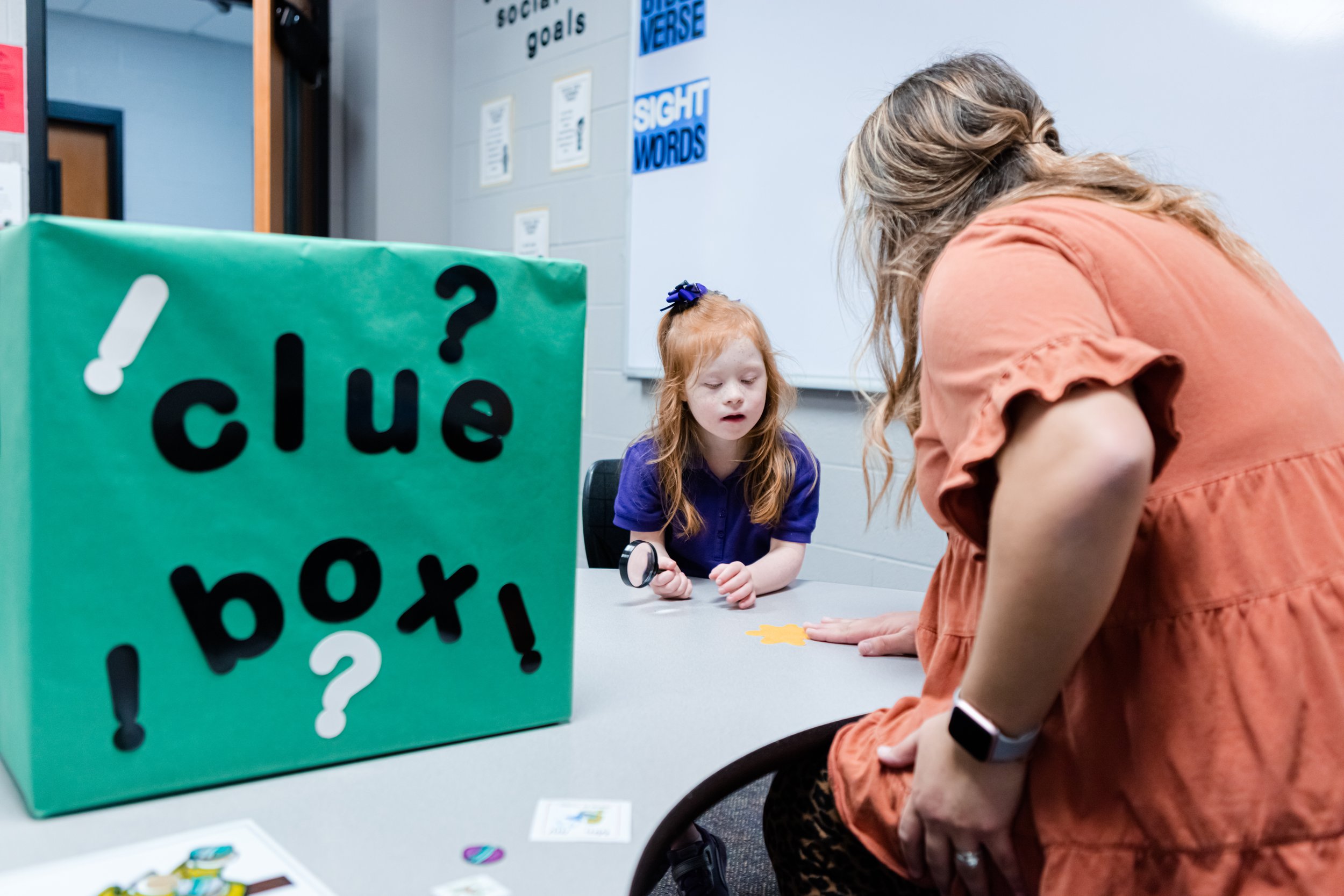

RISE Program

STEM Programs

Technological Advancements

Security Upgrades

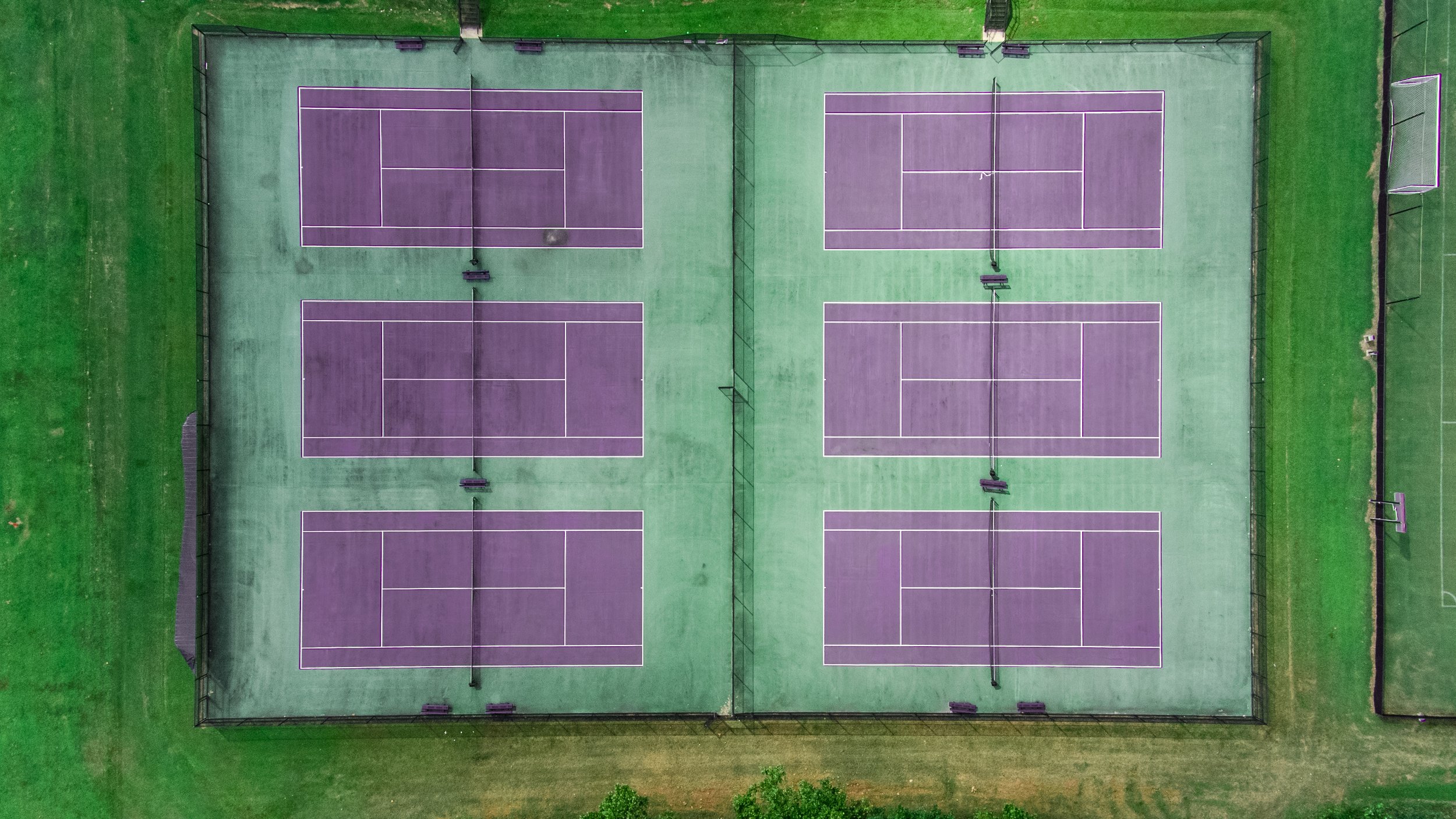

Fine Arts and Athletics

Can I give a designated gift?

Absolutely! Through the Heritage Fund, you can designate a gift to any of the following categories:

Academics

Financial Aid

Discipleship

Security

Fine Arts

Athletics

Technology

How Can I Give to TCA?

-

Click here to give online to the Heritage Fund.

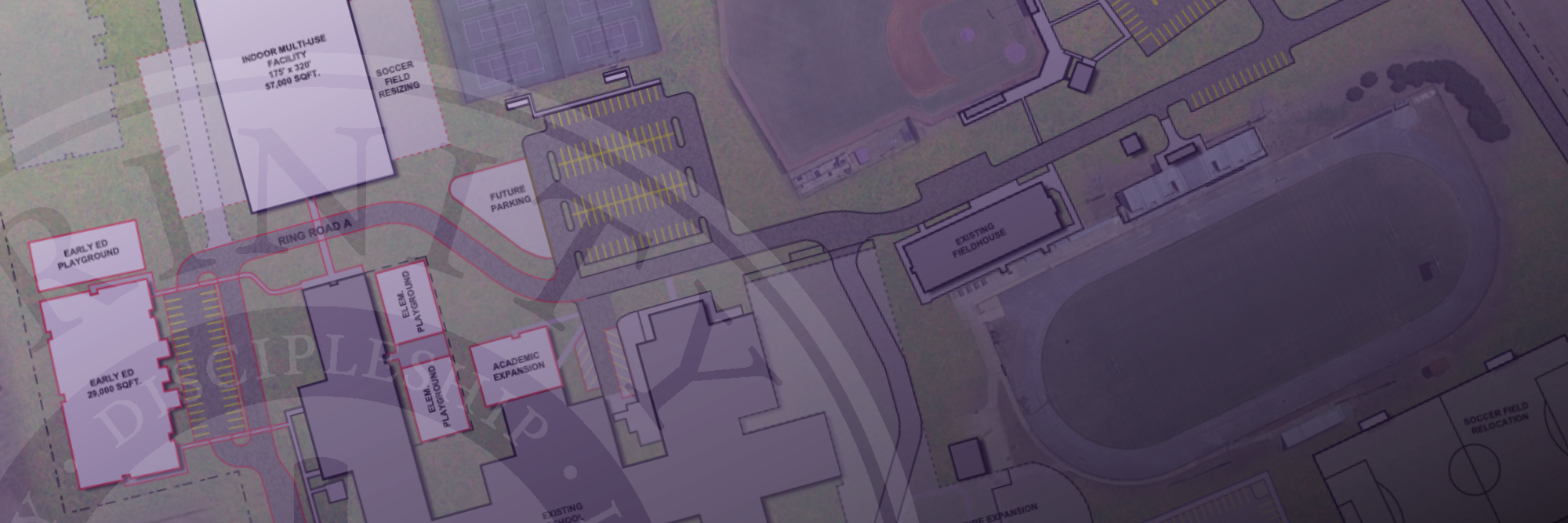

Click here to give to the Visions 2026 Plan.

-

Mail checks to:

Trinity Christian Academy

10 Windy City Rd.

Jackson, TN 38305You can notate with an enclosed letter or in the memo section of your check how you wish to allocate the funds. If you have any questions, please reach out to the TCA Development Office at 731.668.8500.

-

Pledges may be made for donations to the school. This allows donors to spread payments out over a period of time. Trinity can set up an automatic draft from your checking account as payment for a pledge to the school. Contact the TCA Development Office at 731.668.8500 to begin your giving.

-

Honorary gifts recognize individuals or occasions, while memorial gifts honor individuals who have passed away. Gifts are recognized with a card sent to the honoree or family of the memorialized individual.

-

Many companies match their employees’ charitable donations. Enclose a matching gift form from your company with your donation, and Trinity will complete and submit the form to your company.

-

Trinity Christian Academy accepts gifts of stocks and mutual funds which may be advantageous for some donors. Please consult with your financial advisor to discuss this charitable option.

-

Planned giving can include securities, trusts, life insurance policies, real estate, or personal property. Before creating your estate plan, please consider how Trinity Christian Academy aligns with your philanthropic goals and consult your financial advisor to learn more about this option.

-

Gifts to Trinity Christian Academy on or before December 31st will be considered tax-deductible for that year. Checks must be dated and postmarked on or before December 31st. Stock transactions must be initiated on or before December 31st.

If you have questions about giving to Trinity Christian Academy, please reach out to our Development Office at giving@mytcalions.com or call 731.668.8500. Thank you for partnering with us.

-

Ashley Clampitt

Admissions and Development Assistant